The Future of Accounting: How AI is Changing the Industry

The accounting industry is undergoing a major transformation, driven by rapid advancements in Artificial Intelligence (AI) and automation. While traditional accounting relied on manual data entry and calculations, AI-powered tools are now streamlining financial processes, enhancing accuracy, and enabling accountants to focus on strategic decision-making.

For aspiring accountants, this shift presents both challenges and opportunities. Will AI replace human accountants, or will it create new career possibilities? How can students future-proof their skills? If you’re considering a career in accounting, now is the time to understand how AI is reshaping the industry – and why earning a Bachelor of Commerce in Accounting at MANCOSA is a smart move for the future.

This article explores the impact of AI on accounting, the skills needed to thrive in this evolving landscape, and how an online BCom in Accounting can prepare you for success.

Covered in this article

- How AI is Transforming Accounting

- Will AI Replace Accountants?

- Essential Skills for Future Accountants

- How MANCOSA’s BCom in Accounting Prepares You for the Future

- Future-Proof Your Accounting Career

- FAQs

How AI is Transforming Accounting

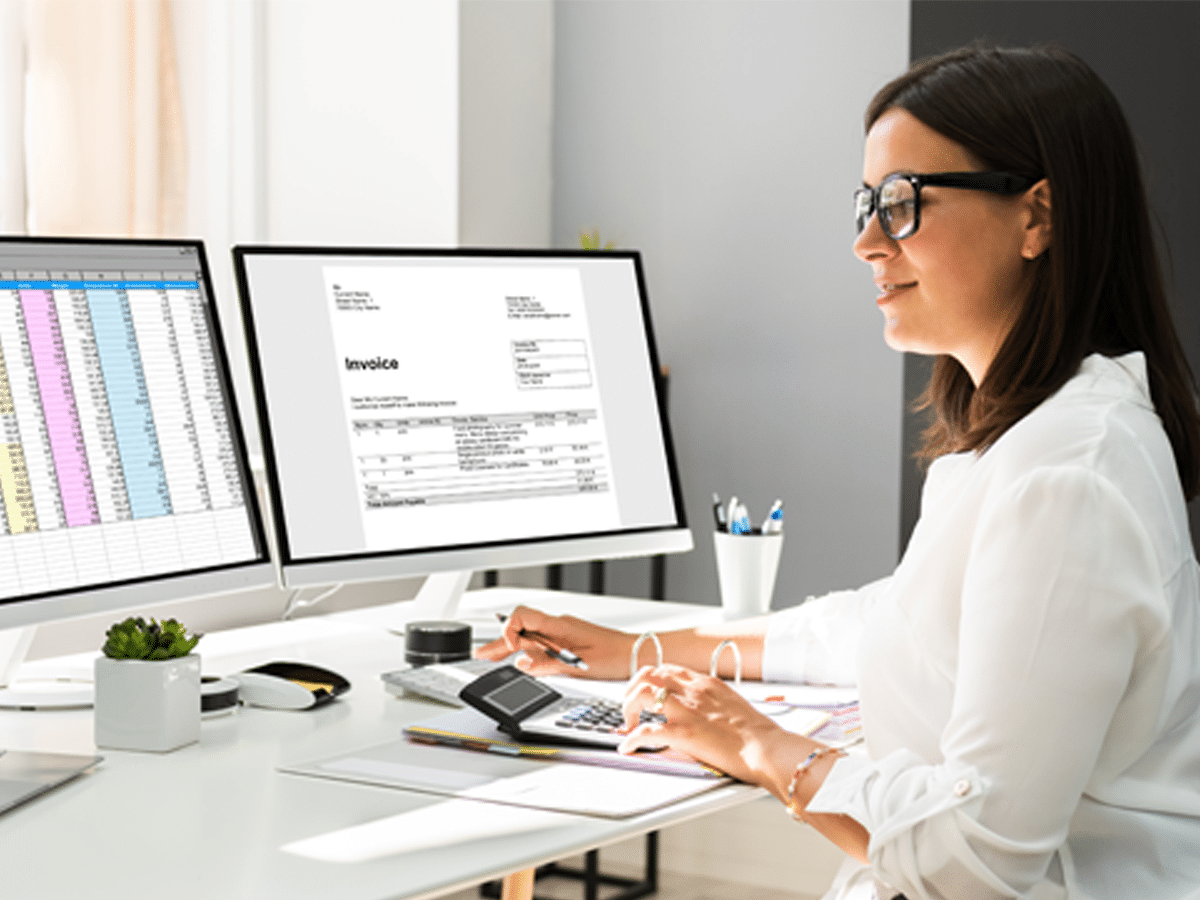

1. Automation of Repetitive Tasks

AI is revolutionising the way accountants handle mundane and repetitive tasks, such as:

- Data entry and bookkeeping – AI-powered software can process large volumes of financial transactions with high accuracy.

- Bank reconciliations – Automated tools match transactions with bank statements in real-time, reducing errors.

- Invoice processing – AI-driven optical character recognition (OCR) extracts data from invoices and updates accounting records automatically.

This automation allows accountants to focus on higher-value tasks, such as financial analysis, strategic planning, and advisory roles.

2. AI-Powered Financial Analysis

AI tools can analyse vast amounts of financial data in seconds, identifying patterns, trends, and potential risks. Machine learning algorithms can:

- Detect fraudulent transactions by recognising anomalies in financial records.

- Provide predictive analytics, helping businesses anticipate cash flow fluctuations.

- Generate real-time financial insights to support decision-making.

3. Enhanced Compliance and Risk Management

AI simplifies regulatory compliance by:

- Monitoring tax laws and automatically updating financial records to align with new regulations.

- Conducting real-time audits to identify errors or inconsistencies before they become issues.

- Reducing human error in tax filing, payroll processing, and financial reporting.

This ensures businesses remain compliant while saving accountants time and effort.

4. AI-Powered Chatbots and Virtual Assistants

AI chatbots are now assisting accountants by:

- Answering tax-related queries.

- Helping clients with basic financial planning.

- Automating customer service tasks.

Rather than replacing accountants, AI-powered assistants enhance efficiency, allowing professionals to handle more complex cases.

Will AI Replace Accountants?

Many people fear that AI will take over accounting jobs, but the reality is AI is an enabler, not a replacement. While AI automates routine tasks, accountants still play a crucial role in:

- Interpreting financial data – AI can process numbers, but human accountants provide strategic insights.

- Ethical decision-making – Accountants ensure compliance with legal and ethical standards.

- Advisory and consulting services – Businesses need human expertise to guide financial strategies.

Rather than eliminating jobs, AI is shifting the role of accountants toward more analytical, advisory, and strategic responsibilities.

Essential Skills for Future Accountants

To stay competitive in an AI-driven accounting landscape, aspiring accountants need to develop:

1. Digital and Data Analytics Skills

Understanding AI-driven accounting software, cloud-based platforms, and data analytics tools is essential. Courses in financial technology (FinTech) and analytics can provide a competitive edge.

2. Strategic Thinking and Problem-Solving

With AI handling repetitive tasks, accountants must focus on strategy, identifying opportunities for business growth and financial optimisation.

3. Ethical and Regulatory Knowledge

AI cannot replace the human judgment needed to navigate ethical and legal complexities. Accountants must stay updated on financial laws, corporate governance, and compliance requirements.

4. Communication and Advisory Skills

As AI takes over data processing, accountants need strong communication skills to explain financial concepts, provide strategic advice, and guide business decisions.

How MANCOSA’s BCom in Accounting Prepares You for the Future

The Bachelor of Commerce in Accounting at MANCOSA is designed to equip students with the modern accounting skills required in an AI-driven world. This online programme offers:

- A strong foundation in accounting principles – including taxation, auditing, and financial management.

- Exposure to AI-powered financial tools – learn how technology is shaping the industry.

- A focus on analytical and strategic thinking – preparing you for leadership roles.

- Flexibility for working professionals – study online at your own pace while gaining real-world experience.

Future-Proof Your Accounting Career

The rise of AI in accounting is an opportunity, not a threat. By developing the right skills and earning a future-focused qualification, you can position yourself as a sought-after financial professional in the digital age.

Ready to take the next step? Explore MANCOSA’s Bachelor of Commerce in Accounting today and build a career that thrives in the era of AI.

FAQs AI in Accounting

1. Will AI replace accountants?

No, AI will automate repetitive tasks, but human accountants are still needed for strategic decision-making, ethics, and advisory roles.

2. How is AI used in accounting?

AI automates bookkeeping, detects fraud, improves financial analysis, and ensures compliance with tax laws and regulations.

3. What skills do accountants need in an AI-driven industry?

Future accountants need digital skills, strategic thinking, data analytics expertise, ethical knowledge, and strong communication abilities.

4. Is MANCOSA’s BCom in Accounting suitable for AI-driven careers?

Yes, MANCOSA’s BCom in Accounting equips students with modern accounting skills, technology exposure, and analytical thinking for AI-powered finance.

5. How can I stay relevant in the accounting industry with AI advancements?

Stay updated on AI trends, learn new financial technologies, develop advisory skills, and earn a qualification like MANCOSA’s BCom in Accounting.

6. Can I study accounting online while working?

Yes! MANCOSA offers a flexible, fully online BCom in Accounting, allowing students to study at their own pace while gaining real-world experience.