What is Risk Management? Understanding the Basics

In an unpredictable world, organisations face a variety of risks that can disrupt operations, impact financial stability, and even threaten their survival. Risk management is the structured approach to identifying, assessing, and mitigating these uncertainties to safeguard businesses and individuals alike.

For professionals in finance, governance, and corporate leadership, understanding risk management is crucial for making informed decisions. Whether you’re looking to enhance your expertise or transition into a risk-focused role, MANCOSA’s Postgraduate Diploma in Risk Management provides the essential knowledge and practical skills to navigate today’s complex risk landscape.

In this article, we will explore the fundamentals of risk management, its importance, and the key components that make up an effective risk management strategy.

Covered in this article

- Why is Risk Management Important?

- Key Components of Risk Management

- Career Opportunities in Risk Management

- Final Thoughts

- FAQs

Why is Risk Management Important?

Every organisation, regardless of industry, is exposed to risks – ranging from financial instability and operational failures to cybersecurity threats and regulatory non-compliance. Without a robust risk management framework, businesses can suffer significant losses, legal penalties, and reputational damage.

Here’s why risk management is essential:

- Enhances decision-making – Leaders can make informed strategic choices by understanding potential risks and opportunities.

- Minimises financial losses – Identifying and mitigating risks early can prevent costly disruptions.

- Ensures regulatory compliance – Many industries have strict regulations that require organisations to manage risks proactively.

- Protects reputation – Effective risk management helps maintain stakeholder trust and brand credibility.

Key Components of Risk Management

Effective risk management involves a structured approach to identifying, assessing, and mitigating potential threats that could impact an organisation. By implementing a systematic framework, businesses can minimise financial losses, ensure regulatory compliance, and protect their reputation.

The risk management process typically includes four key components: risk identification, risk assessment, risk mitigation, and continuous monitoring. Each step plays a crucial role in developing a proactive strategy that enables organisations to navigate uncertainties and make informed decisions for long-term sustainability.

A structured risk management process typically follows these key steps:

1. Risk Identification

Organisations must first identify potential risks that could impact their operations. These risks can be internal (e.g., employee fraud, IT failures) or external (e.g., economic downturns, natural disasters). Common risk categories include:

- Strategic risks – Affect long-term business objectives.

- Operational risks – Arise from day-to-day processes.

- Financial risks – Related to market fluctuations, liquidity, and investments.

- Compliance risks – Involve legal and regulatory obligations.

2. Risk Assessment & Analysis

Once risks are identified, they need to be assessed in terms of likelihood and impact. Organisations typically use risk matrices to categorise risks from low to high severity, prioritising those that require immediate attention.

3. Risk Mitigation Strategies

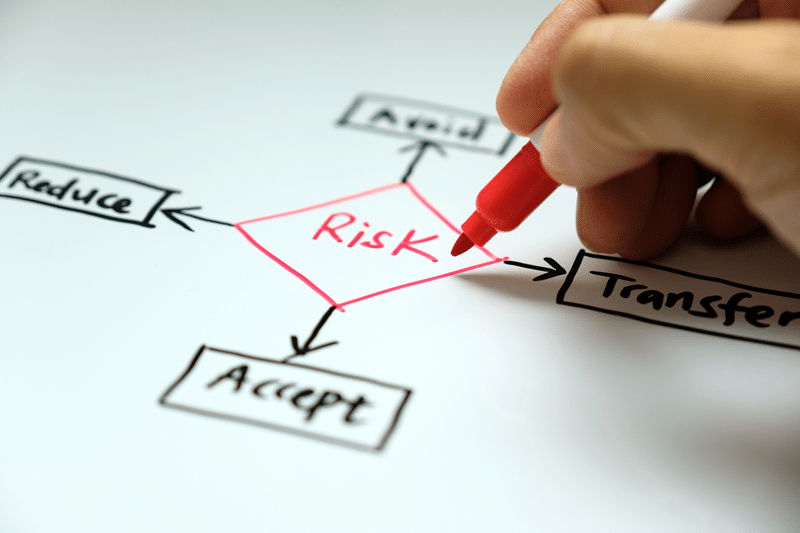

Mitigating risks involves implementing controls and strategies to reduce their impact. Common approaches include:

- Avoidance – Eliminating risky activities.

- Reduction – Implementing safeguards to minimise exposure.

- Sharing – Transferring risk through insurance or outsourcing.

- Acceptance – Recognising risks that are manageable and preparing contingency plans.

4. Risk Monitoring & Review

Risk management is an ongoing process. Organisations must continuously monitor emerging risks, review existing strategies, and update risk frameworks to stay ahead of potential threats.

Career Opportunities in Risk Management

As businesses face increasing uncertainties, the demand for skilled risk management professionals continues to grow. Organisations across industries require experts to assess potential threats, develop mitigation strategies, and ensure compliance with regulatory standards.

Careers in risk management span various roles, including risk control officers, compliance managers, and enterprise risk consultants. With the right qualifications, such as a Postgraduate Diploma in Risk Management, professionals can enhance their expertise and unlock diverse career opportunities in finance, governance, and corporate risk strategy.

With businesses prioritising risk mitigation, demand for qualified risk professionals is growing. A Postgraduate Diploma in Risk Management opens doors to careers such as:

- Risk Control Officer/Manager – Develops and enforces risk policies within organisations.

- Risk Management Consultant – Advises businesses on risk assessment and mitigation strategies.

- Compliance Manager – Ensures companies adhere to legal and regulatory requirements.

- Enterprise Risk Management Consultant – Designs risk frameworks for large organisations.

Final Thoughts

Risk management is more than just an organisational safeguard—it is a strategic function that supports sustainable growth. Whether you are a business professional looking to upskill or an aspiring risk analyst, gaining expertise in risk management is a valuable investment in your career.

Take the next step in your risk management journey.

Explore MANCOSA’s Postgraduate Diploma in Risk Management and future-proof your career today!

FAQs About Risk Management

1. What is the main purpose of risk management?

Risk management aims to identify, assess, and mitigate potential risks that could negatively impact an organisation’s objectives. It helps businesses reduce uncertainties, improve decision-making, and ensure long-term sustainability.

2. What are the different types of risk?

Risk can be classified into various categories, including strategic risks, operational risks, financial risks, and compliance risks. Each type requires different management approaches depending on the industry and business goals.

3. How is risk measured?

Risk is typically measured by evaluating its probability (likelihood of occurrence) and impact (potential consequences). Risk assessment tools, such as risk matrices and Monte Carlo simulations, help organisations quantify risks and prioritise mitigation efforts.

4. What are the biggest challenges in risk management today?

Modern risk management faces challenges such as cybersecurity threats, regulatory changes, climate-related risks, and global economic instability. Organisations must continuously adapt to evolving risks through proactive strategies.

5. Do all businesses need a formal risk management plan?

Yes, businesses of all sizes benefit from having a risk management plan. While large corporations may have dedicated risk management departments, small businesses can implement basic risk assessment and mitigation strategies to safeguard their operations.

6. What qualifications are needed for a career in risk management?

A background in business, finance, law, or economics is beneficial for risk management roles. Advanced qualifications, such as a Postgraduate Diploma in Risk Management, provide the specialised knowledge required to excel in this field.

7. How does risk management apply to individuals?

Risk management is not just for businesses – it also applies to personal finance, career planning, and investments. Individuals can manage risks by diversifying income sources, obtaining insurance, and planning for financial security.